Case Study III:

Summit Financial Application

UX DESIGN

A UX case study designing Summit, a budgeting app that builds financial confidence through visual clarity and guided goal setting

-

Co-conducted user research and competitive analysis to identify user pain points and product gaps

Developed the visual identity of the app, aligning brand language with the “hiking” metaphor

Designed high-fidelity prototypes for onboarding, goal creation/editing, and money transfer flows

Created friendly UX copy and interface animations to introduce Scout, the virtual assistant

Led revisions post–user testing, focusing on simplifying information architecture and improving clarity

Synthesized usability findings and implemented feedback into final high-fidelity prototypes

-

Figma (wireframes, UI design, prototyping)

FigJam (user flows, site map, task analysis)

Zoom (user interviews)

ChatGPT for image generation

Adobe Photoshop (refining images)

-

Had to balance a playful metaphor with financial clarity and trust.

Limited user testing (5 participants) restricted iteration depth.

Mobile-first design required careful layout prioritization.

Sensitive financial content demanded clear, reassuring language.

Year: 2025

Role: UX Researcher + Designer

Timeline: 4 Weeks

A collaborative UX research and design project for Summit, a financial literacy and budgeting app developed for HorizonBank. Designed for emerging earners, Summit empowers users to set clear financial goals, track their progress visually, and build confidence through intuitive, personalized guidance—all while guided through a visual hiking metaphor.

Process + Beginning

1. Context + App’s Framing

A mobile app designed to help HorizonBank customers build financial confidence through goal tracking, simple savings flows, and guidance from a virtual assistant—all while visualizing their financial ascent.

2. Problem Statement

Financial tools can be overwhelming and jargon-heavy for first-time budgeters. Summit aimed to reduce cognitive barriers by offering clear savings visualizations, emotionally resonant metaphors, and a guided user experience that felt approachable, secure, and empowering.

Research +Users

3. Research & Competitor Analysis

Studied tools like Buddy, GreenBooks, TD MySpend, and Tangerine. Common issues:

I. Clunky visuals or overwhelming data

II. Limited emotional resonance or human support

III. Ineffective onboarding + poor user guidance

4. Users + Audience

Summit targets young earners who:

I. Are between 20 - 35

II. Are new to budgeting and saving

III. Wish to build confidence around money management

IV. Need emotional support and intuitive guidance

V. Value flexibility, security, and visual feedback in financial tools

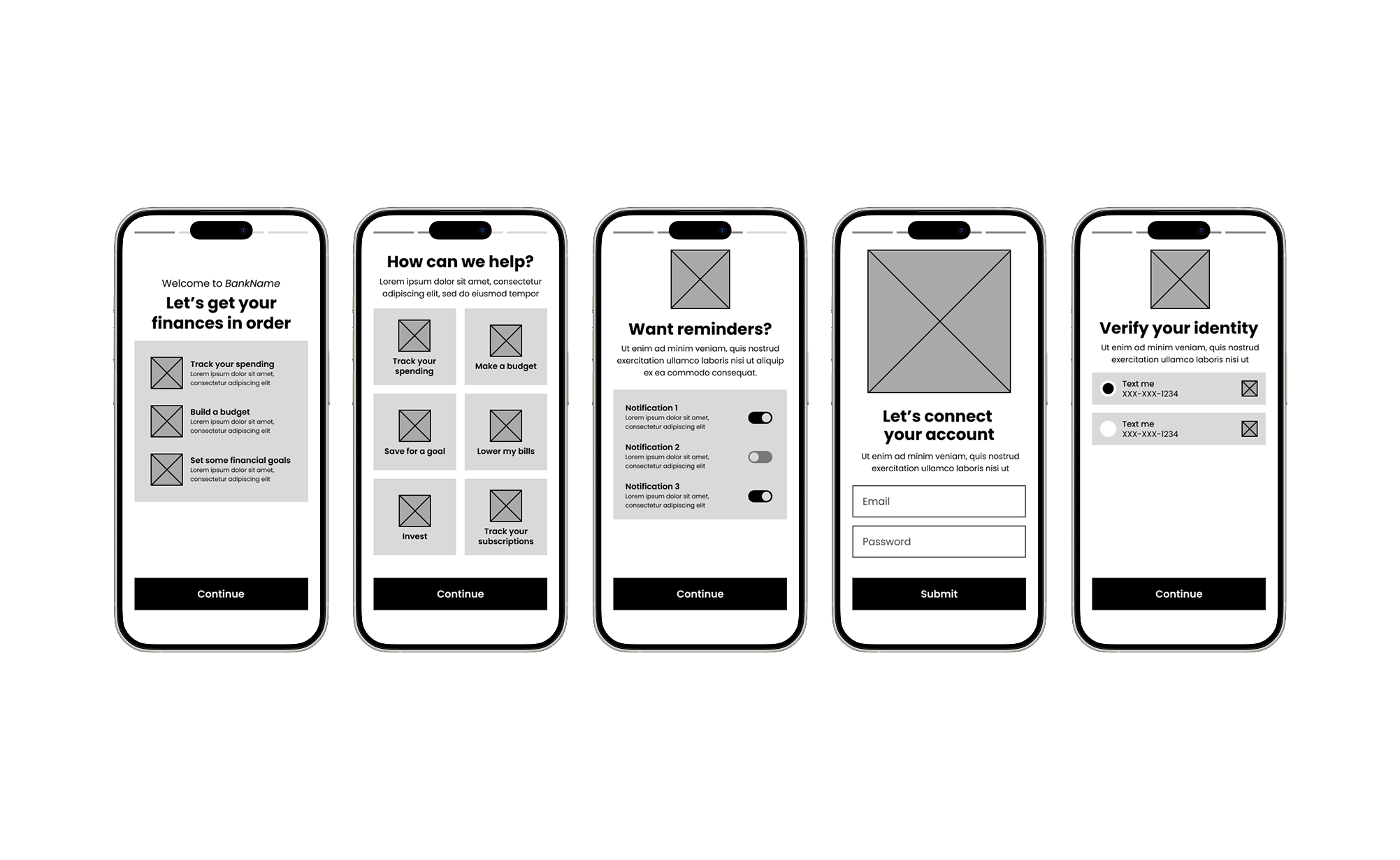

5. Wireframes

A Visual Ascent

Summit uses a hiking metaphor to reframe budgeting as a journey of steady progress rather than restriction.

Visual elements—like goal badges, trail markers, and elevation-themed graphs—help users track their “ascent” toward financial milestones, reinforcing motivation through clear, achievable steps.

Key Features Designed

1

Onboarding Flow

Created a badge-style flow with simplified steps and skip options for a smoother first-time experience.

2

Scout Integration

Refined Scout’s presence with contextual prompts and light animations to support, not overwhelm.

3

Visual Identity Design

Designed a calm, trust-driven interface using earthy tones, soft shadows, and rounded elements.

4

Brand Language + Tone

Wrote clear, encouraging UX copy to align with Summit’s supportive and motivational voice.

The redesigned experience noticeably increased user confidence and reduced confusion during goal setup and money transfers. Participants reported clearer navigation, appreciated the streamlined onboarding flow, and found Scout more helpful and less intrusive after contextual adjustments.

Key takeaways included the importance of simplicity, tone, and pacing—especially for users managing financial stress. Subtle guidance and friendly, clear structure proved more effective than dense instructions or overly gamified features. In future iterations, I would prioritize earlier testing with users from diverse financial backgrounds to better address accessibility and trust across the full journey.

To measure success, we outlined KPIs tied to onboarding completion, goal creation, and user engagement with Scout. Our target was a 75%+ onboarding completion rate, increased weekly check-ins, and higher interaction rates with in-app prompts. From a business perspective, Summit supports HorizonBank’s long-term ROI by fostering early financial literacy and encouraging product loyalty—positioning the app as a gateway to deeper customer relationships and future financial services.